- Budgeting apps can help you save money and keep track of your finances

- Top free budgeting apps include PocketGuard, Honeydue and Mint

- Using budgeting apps shows lenders that you are a responsible borrower

When it comes to saving money, working on your credit rating or keeping up credit payments, budgeting is the most important. Keeping track of your income and expenditures might not be too difficult while things are going well for you financially, but unexpected expenses may leave you in a tricky situation. To avoid being caught out by unforeseen bills or a broken-down car, you can budget to put money aside for an emergency. Technology can help you out here, with budgeting apps.

What Are Budgeting Apps?

Budgeting apps can be downloaded to your smartphone or tablet to help you keep track of your spending day to day. An app can help track your personal finances all in one place and available on the go. This should be able to give you an overall understanding of how much you’re earning, how much you’re spending, what you’re spending it on and where you may need to make changes. There are also loan apps which you can download to make it easier to meet repayments when you have an outstanding loan.

What are the Best Budgeting Apps?

There are many budgeting apps that can help you achieve your financial goals. Some of the best free budgeting apps on the market are the following:

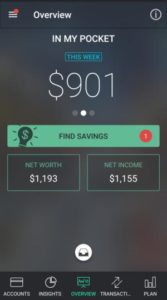

PocketGuard

PocketGuard allows you to connect all of your accounts (checking, credit and savings) and can preempt recurring bills and incoming payments. Through this, it is able to display how much money is available for spending and helps you set specific savings goals.

Use PocketGuard to help you manage your finances

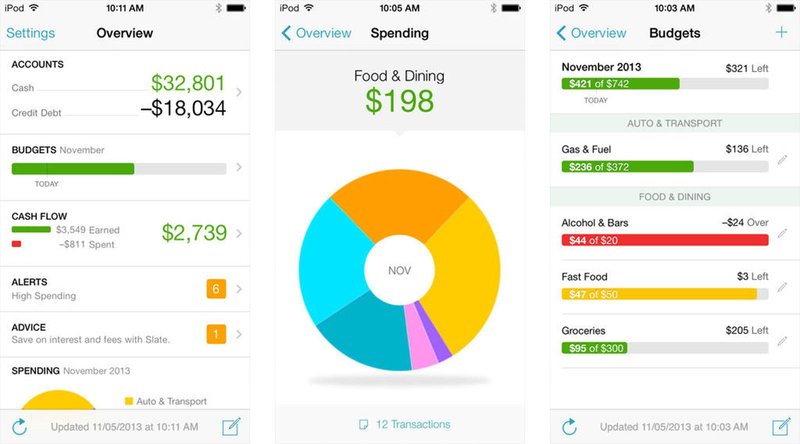

Mint

Mint is an app which tracks and categorises your transactions in order to see where your money is going. It sends notifications to let you know if you are spending over budget in a particular category and flags any suspicious transactions. It can also track any bills and send reminders about future payments.

Mint budgeting app helps you categorise your payments to see where your money is going

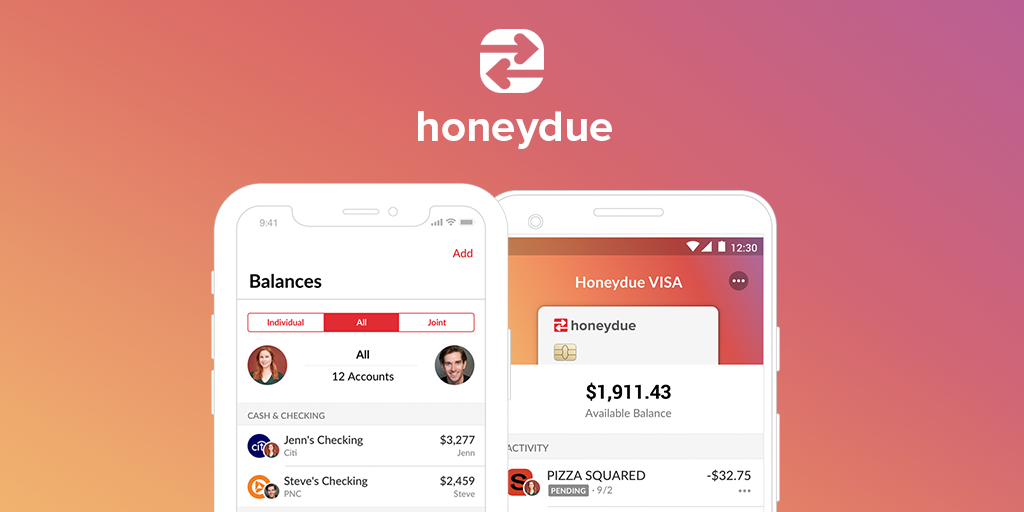

Honeydue

This is a great track for budgeting as a couple as you can see your overall financial picture in one place. The app allows you to track bank accounts and credit cards as well as loans and investments. Honeydue helps for long-term financial planning and setting specific savings goals as a couple.

Honeydue helps couples manage their long-term finances

How Can Budgeting Apps Help Me Save Money?

Simply downloading an app won’t result in better money management or increased savings. However, used over a long time, budgeting apps can help you to stick to good habits that can save you money. You may have multiple savings goals that you are looking to achieve through budgeting. When you are trying to save money, using an app to reach a determined goal that you’re working towards can be a huge help.

Overspending breaks your budget. Using a budgeting app may begin to reveal where you are spending too much. You may not have realised that so much of your money goes on clothes shopping, eating at restaurants or other activities which can be cut down. Once you understand where you are overspending, you can start to curb spending in these areas to keep your budget on track. Have a look at our guide where we break down the simple ways you can shop well while on a budget. Once you begin to save small amounts each month, you can put them aside into a savings pot which will be a saving grace should you run into any financial emergency. This way, if you need to pay for a hospital bill, car repairs or another unexpected cost, you have the cash set aside to do so without taking on loan debt.

Budgeting apps can help you set financial goals

How Can Budgeting Apps Help Me Get A Loan In Future?

By encouraging good spending habits and helping you stick to your financial commitments, budgeting apps can boost your credit rating. This makes you a low-risk customer to lenders. Using budgeting and loan apps can help you show lenders that you’re a responsible borrower. This is particularly effective in improving your credit score if you are someone who has been approved for small loans regularly and is always able to meet the repayments at the right time. Boosting your credit rating can also help you out when requesting a loan for a mortgage, credit card, or even a phone contract.