What is a Payday Loan?

A payday loan is traditionally used to help you borrow money until your next payday. With the average American getting paid at the end of each month, it is very common to have a shortfall of cash or to need a couple of hundred bucks until your next pay date. Maybe it is a household emergency, car repairs or your rent is due.

Also known as a ‘payday advance,’ you can get money upfront and paid in one lump sum to pay off any pressing bills — and then you can repay the loan and interest in full on your next pay date. So ideally, your emergency is just a one-off and you can be back on your feet in no-time.

Today, with payday loan apps and alternatives, the average loan will typically last a couple of weeks — and Pheabs is able to give options ranging from 12 to 60 months. This gives you a bit more breathing space and rather than borrowing $300 and paying back in full just a few weeks later, you may wish to borrow a bit more and for longer.

Key Features

| Loan Amounts | Borrow $100 to $35,000 |

| Loan Duration | Repay over 1 to 60 months |

| Online Application | Yes |

| Bad Credit Considered | Yes |

| Same Day Funding | Yes |

| Must Be Over 18 | Yes |

Representative Loan Example: Borrow $300 over 3 months, at 400% APR, 3 equal repayments of $218.91, total to repay $518.91

What Are Payday Loans Used For?

Payday loans are for short-term purposes and lasting just a few weeks, they are intended to cover shortfalls of cash for households. The idea is that you receive the money upfront in lump sum to help pay off your emergency, and then you can receive your income from work on your next payday, and then pay back your loan in full — including:

- Emergencies

- Car repairs

- Household repairs

- Broken boilers

- Medical bills

- Groceries

- Rent

- Unexpected bills

- Funerals

Payday loans are not designed for:

- Luxury holidays

- Gifts and presents

- Non-essential surgery

- Shopping sprees

- Gambling

- High risk investments

- Long term purposes

What Information Do I Need to Apply for a Payday Loan?

- Your name

- Your address

- Your date of birth

- Cell phone number

- Email address

- Your monthly income

- Your employment details

- The amount you wish to borrow

- The length you would like to borrow for

- Your social security number

- Your checking account number

It is important that you attempt to give the most honest information possible, including information about your address, employment and income. Any anomalies could be flagged by our team and require us to ask for further proof which could slow down your application.

Payday loans are unsecured, so a lot of the decisions are made automatically so that your loan can be funded on the same day. By giving accurate information, we can get your application ready for funding immediately.

In some cases, you may request a copy of your address, bank statement or a pay stub from work — and this is not uncommon for those looking to borrow larger amounts of $1,000, $2,000 or $5,000.

Am I Eligible For A Payday Loan From Pheabs?

- You must be a U.S. or Canadian resident

- At least 18 years of age

- Have a steady employment

- Earning at a minimum of $800 per month

- A live checking account for your loan to be deposited into

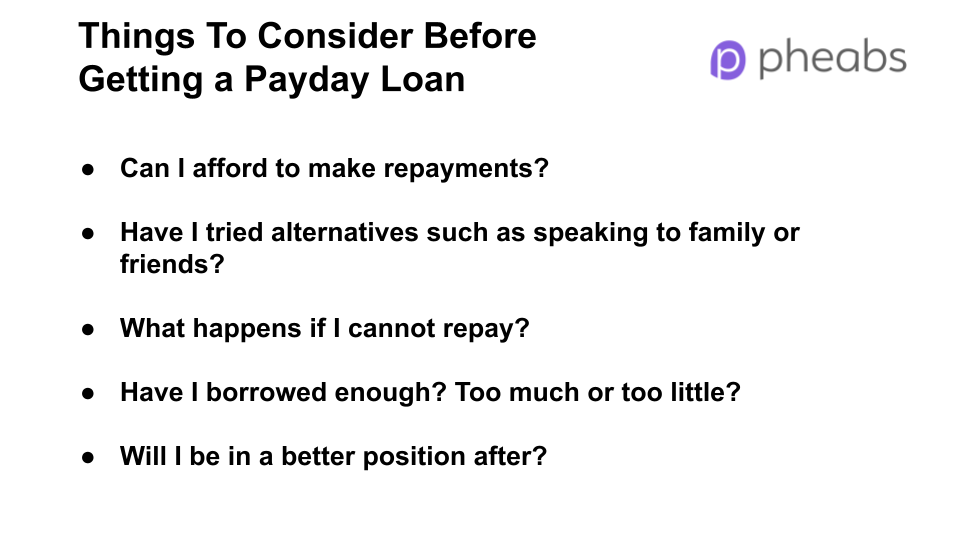

- You must be able to afford repayments

How Do Repayments Work?

Repayments for payday loans work in equal monthly installments — so if you borrow over 3 months, you will be paying 3 identical repayment amounts at the end of each month.

Depending on which lender you are connected with, you can repay your loan after just one month, or as long as 12 months or 60 months if you prefer.

For quick and fast payday loans, you may need to borrow money upfront, pay off any pressing debts and then repay your loan in full at the end of the month — so it only ends up lasting just a few weeks.

But if you are borrowing some of the larger amounts such as $1,000, $5,000 or $10,000, you may wish to spread repayment over 12, 24, 48 or 60 months to give you extra breathing space.

The lender will collect the repayments from your bank account each month automatically, so you do not need to call up, make a manual payment or send in a cheque, it is all processed automatically to make life easier.

Can I Get A Payday Loan With Bad Credit From Pheabs?

Yes, you can get a payday loan with bad credit scores — we work with a number of different lenders who are willing to consider all kinds of credit scores and can offer the right products for you.

When applying for a payday loan online, you are not expected to have a perfect credit score — and our lenders will take in other factors such as your income, employment, age and the amount you have requested to borrow. All of these factors can tell the lender a lot about your chances of repaying a loan — and it is not just the credit score that they look at.

Can I Get A Payday Loan With No Credit Checks?

Payday loans without credit checks are a little harder to find. Regulated and licensed payday lenders in the US typically need to run a credit check before approving your loan request. This will confirm that you can afford to repay your loan based on your credit history and will not fall into difficulty.

Although most loan companies will run a credit check, there are some other lenders who will use other indicators such as pay check, monthly income and employment information — and still approve your loan on this basis.

For larger loans, they may request collateral and secure your loan against a car, property or jewellery, but these are more long term loans, rather than payday loans. However, when secured against something valuable, the success of your loan is based more on the item’s value, rather than your credit score, so it is possible to submit a loan request with no credit checks.

What Payday Loan Alternatives Are There?

There are a number of payday loans alternatives available through Pheabs and the partners that we work with, including a range of products, apps, startups and more.

One of our main alternatives is installment loans, which allow you to spread repayment over several months and this is often preferred by a lot of customers, since it means you do not need to pay the full balance at the end of the month, but you have time to get your finances in order and get back on your feet.

Other products we can offer include title loans, which are secured against your car or using different apps which allow you to drawdown money, repay and top up if you need to.

Of course, one of the best and oldest alternatives is to simply borrow money from family and friends. This is usually interest-free, not subject to credit checks and comes with flexible repayment terms. This should usually be your first point of call if you need emergency cash. But if you are looking to apply online and get a quick turnaround, Pheabs is delighted to help you with your requirements every step of the way.

Where Can I Find a Payday Loan With Guaranteed Approval?

If you looking for a guaranteed payday loan online, this is not always possible since you will need to meet the initial criteria in terms of age, employment, minimum income and be able to pass our series of credit checks and affordability checks.

Whilst a guaranteed loan is not always possible, we work with such a wide range of lenders that we will do our best to give you a loan offer today. We will always consider different applicants and backgrounds and in some cases, we may recommend credit unions, apps or using a product secured against your car or home.

Can I Get a Payday Loan on The Same Day of Applying?

Yes, it is possible to get a same day payday loan, so long as you meet the criteria, which includes being over 18 years of age, have a stable employment and income, social security number and live checking account for your funds to be paid into.

To maximise your chances of receiving loans on the same day, make sure that all the information that you enter is accurate and that you meet all the criteria points provided. It might be helpful to have a copy of your pay stub or bank statement in case the lender asks for proof of income or employment.

Finally, if you apply during work hours of Monday to Friday from 9AM to 5PM, this should also maximise your chances of getting funds within 24 hours, rather than applying on a slow Sunday or national holiday.

Can I Get a Payday Loan With an Instant Decision?

Yes, payday loans are designed to give you instant approval, so you can fill in your details in less than 5 minutes and receive an indicative decision on the screen. Because the loans are unsecured, your eligibility is based on various factors which can be processed automatically, giving you an instant decision. However, to be fully approved and funded, you will need to electronically sign your loan agreement and often undergo further checks such as credit and affordability checks — just so you can afford the amount you wish to borrow without falling into financial trouble.

Can I Apply for Loans Near Me?

Yes, by working with a number of payday loans companies near me, we can connect your loan enquiry with a lender who is based in your State, including Nevada, Texas, Ohio, California and Illinois (and all 37 states where payday loans are legalised).

This can be important, since loan terms and interest rates can vary between States. However, we also work with lenders who operate in multiple jurisdictions so that you can be approved wherever you are in the US.

Whilst a lot of these States offer local payday stores, our process is fully online, so you do not have to visit a branch, line up or wait for a decision. Everything with Pheabs is handled and processed online, so you can complete our application form in 5 minutes, get an instant and receive funds in just a few hours if you are approved.

FAQs For Payday Loans From Pheabs

Why Should I Apply for Payday Loans Direct Lenders?

Working with direct lenders can offer a lot of peace of mind when applying for loan. When you are working with the lender directly, you can feel confident that your details are being kept safely and that you are in control of your application.

At Pheabs, we work with direct lenders only, so once you have completed our form, you will continue to work with your selected lender every step of the way. From the loan being processed, funded and repayments collected, everything will be handled by your chosen lender and you can be rest assured that there are no surprise fees or other parties involved.

How Much Does a Payday Loan Online Cost?

The cost of a payday loan ranges from 36% APR to 5,000% APR depending on various factors such as your credit score, income, affordability and also the State that you live in. After all, some US States have price caps and others are more lenient to charge higher amounts.

Representative example:

Based on a loan amount of $750 over 12 months. Rate of interest 292% (fixed). Representative 171% APR. Total repayment amount $1351.20 and total interest is $601.20, equal to 12 monthly payments of $112.60.*

For good credit score customers, you may be able to access ranges from 36% APR, but those with bad credit histories are more likely to pay up to 5,000% APR.

Whilst this percentage rate might seem very high, this is designed to be used for just a few weeks and then repaid in full. The APR is a measure of annual interest which is 12 months, and therefore your rate is multiplied over and over and is not necessarily a try reflection of the cost.

What Payday Loan Alternatives Are There?

There are a number of payday loans alternatives available through Pheabs and the partners that we work with, including a range of products, apps, startups and more.

One of our main alternatives is installment loans, which allow you to spread repayment over several months and this is often preferred by a lot of customers, since it means you do not need to pay the full balance at the end of the month, but you have time to get your finances in order and get back on your feet.

Other products we can offer include title loans, which are secured against your car or using different apps which allow you to drawdown money, repay and top up if you need to.

Of course, one of the best and oldest alternatives is to simply borrow money from family and friends. This is usually interest-free, not subject to credit checks and comes with flexible repayment terms. This should usually be your first point of call if you need emergency cash. But if you are looking to apply online and get a quick turnaround, Pheabs is delighted to help you with your requirements every step of the way.

How Much Can I Borrow From a Payday Loan?

Pheabs offers payday loans of $300, $500, $1,000, $2,000 or higher — the amount you can borrow is based on a number of factors including your income, employment, credit score, affordability, track record and more.

Can I Make Loan Repayments Online or By Phone?

Your repayments are collected automatically through a system known as ACH authorization which debits your account on your scheduled repayment date. There is no need to call up or make a manual repayment since this is designed to be automatic, you just need to have money available in your account on the agreed date for collection. If you prefer, you can always call up or log into the account section of your lender’s website and make a manual repayment or pay off your loan early if you would like to.

Can I Renew My Payday Loan?

Yes, you may have the option to renew your payday loan once you have paid off your existing loan in full. Your lender will typically carry out a series of checks to determine how much you can borrow and if a payday loan is still right for you. This may involve being declined, receiving a lower or similar amount, or even a much higher amount if you have built up trust with the lender.

What if I am Unable To Repay My Payday Loan on My Due Date?

If you are struggling to make repayment, you must alert your lender as soon as possible. Typically, late repayment will incur late fees, additional interest and it will negatively impact your credit score. However, you can limit this by speaking to your lender and explaining your situation. The lender may be able to extend or delay repayment and remove any added fees — so the most honest and open you are with them, the better.