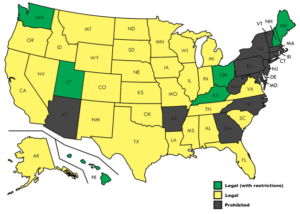

The United States has the largest payday lending industry in the world, and payday loans are legal in 37 states. The biggest states for payday lending include California, Texas and Las Vegas, Nevada.

Payday lending is an industry that provides short-term loans to borrowers who may have difficulty obtaining credit through traditional means. While payday loans can be helpful in emergency situations, they often come with high interest rates and fees.

According to the Pew Charitable Trusts, 12 million Americans use payday loans each year, with an estimated $9 billion borrowed annually.

While payday loans are legal in 37 states, the regulations surrounding them vary widely. Some states have strict regulations on payday lending, such as limiting the amount of interest that lenders can charge or capping the number of loans that a borrower can take out in a certain period of time. Other states have fewer regulations, allowing lenders to charge higher interest rates and fees.

The payday market is thriving in the United States. Although regulations vary across the country, the United States is the world’s largest payday loan industry. There are approximately 23,000 payday lenders in the US, including storefronts and online lenders. It is estimated that each year, approximately 12 million American’s take out a payday loan.

Why Are Payday Loans So Popular in the United States?

Payday loans are popular in the United States because they provide quick and easy access to cash for people who may not have access to traditional forms of credit. Reasons for their popularity include:

- Easy to qualify: Payday loans are easy to qualify for, as lenders typically only require proof of income and a bank account. This means that people with poor credit or no credit history can still get approved for a loan. There is often no credit check.

- Quick access to cash: Payday loans are designed to provide quick access to cash, often within a day or two of applying. This makes them an attractive option for people who need money quickly to cover an unexpected expense such as a medical bill.

- No collateral required: Unlike other types of loans, payday loans do not require collateral, such as a car or house. This means that borrowers do not have to put their assets at risk in order to get a loan, and do not risk getting their home seized if they cannot repay their loan.

- Convenient: Payday loans are available online and in-store, making them a convenient option for people who need money quickly. Borrowers can apply for a loan from the comfort of their own home or go to a storefront location to apply in person.

In Which Other Countries Are Payday Loans Popular?

Payday loans are popular in several other countries besides the United States, including:

- United Kingdom: Payday loans have been popular in the UK since the early 2000s. The industry grew rapidly until the government introduced stricter regulations in 2015, including a cap on interest rates and fees.

- Canada: Payday loans are legal and popular in Canada, with an estimated two million Canadians using payday loans each year. The industry is regulated by each province and territory, with some jurisdictions imposing restrictions on interest rates and fees.

- Australia: Payday loans have been legal in Australia since 2006, and the industry has grown rapidly in recent years. The government has introduced new regulations to protect consumers, including a cap on interest rates and fees.

- New Zealand: Payday loans have been legal in New Zealand since 2008, and the industry has grown rapidly in recent years. The government has introduced new regulations to protect consumers, including a cap on interest rates and fees.

- South Africa: Payday loans are legal and popular in South Africa, with an estimated three million South Africans using payday loans each year. The industry is regulated by the National Credit Regulator, which imposes restrictions on interest rates and fees.

How Much Do Payday Loans Cost in the United States?

The cost of a payday loan will vary by lender. Each state also has a different cap on APR, meaning a loan of $100, for example, will cost a different maximum amount to take out in each state, as seen in the table below:

State |

Cost per $100 |

| Alabama | $17.50 |

| Alaska | $20 |

| Arizona | N/A |

| Arkansas | N/A |

| California | $17.65 |

| Colorado | $7.50 |

| Connecticut | N/A |

| Delaware | No Limit |

| Florida | $16.11 |

| Georgia | N/A |

| Hawaii | $17.65 |

| Idaho | N/A |

| Illinois | $15.50 |

| Indiana | $15 |

| Iowa | $16.67 |

| Kansas | $15 |

| Kentucky | $17.65 |

| Louisiana | $30 |

| Maine | N/A |

| Maryland | N/A |

| Massachusetts | N/A |

| Michigan | $15 |

| Minnesota | $15 |

| Mississippi | $20 |

| Missouri | $75 |

| Montana | $1.39 |

| Nebraska | $17.65 |

| Nevada | No Limit |

| New Hampshire | $1.38 |

| New Jersey | N/A |

| New Mexico | N/A |

| New York | N/A |

| North Carolina | N/A |

| North Dakota | $20 |

| Ohio | $1.08 |

| Oklahoma | $15 |

| Oregon | $13 for a 31-day loan |

| Pennsylvania | N/A |

| Rhode Island | $10 |

| South Carolina | $15 |

| South Dakota | No Limit |

| Tennessee | $17.65 |

| Texas | $11.87 |

| Utah | No Limit |

| Vermont | N/A |

| Virginia | $26.38 |

| Washington | $15 |

| West Virginia | N/A |

| Wisconsin | $30 |

| Wyoming | No Limit |

| Washington DC | N/A |

How Are Payday Loans Regulated in the United States?

Payday lending is regulated by the Consumer Financial Protection Bureau. President Obama introduced the legislation after the 2008 financial crisis. However, local governments can choose whether to legalize lending in their state. There are 16 states and the District of Columbia which implement caps on interest rates at 36%.

There are also a set of requirements to make a loan request. These often include:

- You must be a U.S. resident

- You must be over the age of 18

- You need steady employment and a stable income

- You earn a minimum of $800 per month

- You have a valid and working mobile phone account

- You have a live checking account for your loan to be deposited into

- You can afford to meet repayments

Where in the United States Are Payday Loans Legal?

According to the CFPB, 32 states allow these types of lending without significant restrictions. In these states, it’s not uncommon to find APRs exceeding 400 per cent.

There are 12 states — Arizona, Arkansas, Georgia, Maryland, Massachusetts, New Jersey, New York, North Carolina, New Mexico, Pennsylvania, Vermont, and West Virginia — in which payday loans are entirely illegal.

How Can I Tell if a Payday Lender Is Legally Licensed in My State?

If you are considering taking out a payday loan, it is important to ensure that the lender is legally licensed in your state. Here are some steps you can take to determine if a payday lender is licensed in your state:

- Check with your state’s financial regulatory agency: Each state has a financial regulatory agency that oversees the payday lending industry. Check the agency’s website to see if the lender you are considering is licensed to operate in your state. You can also contact the agency directly to confirm a lender’s license status.

- Look for the lender’s license number: Many payday lenders display their license number on their website or in their storefront. If you see a license number, you can look it up on your state’s financial regulatory agency’s website to confirm its validity.

- Check the Better Business Bureau: The Better Business Bureau (BBB) is a non-profit organization that provides information on businesses, including payday lenders. Check the lender’s BBB profile to see if they are accredited and if there have been any complaints filed against them.

- Read the loan agreement carefully: By law, payday lenders must disclose certain information in the loan agreement, including their license number and the state in which they are licensed. Make sure to read the agreement carefully and look for this information.