Last Updated on October 24th, 2023 at 02:56 pm

When filling out an online submission form for a loan, you’ll typically need to provide the following pieces of information:

- The loan amount you want to borrow.

- How long you want to borrow the loan for.

- Your diver’s license number/or state ID.

- Your contact details – including phone number and email address.

- Your employment status.

- A valid checking account.

With Pheabs, the form process for a payday loan is done entirely online, only takes a few minutes to complete, and gives you an instant decision.

You don’t even have to leave your sofa. Just do it all from your laptop or smartphone. When you submit an enquiry, it’s best to have the details listed above on hand.

Here, Pheabs answers some of the most common questions surrounding the application process for a payday loan.

How Do I Submit an Enquiry for a Payday Loan?

We offer a fully online experience, making the sometimes difficult task of finding a simple and convenient payday loan. Our online loan form is designed to be as easy as possible to fill out with instant results. We give you access to hundreds of direct lenders across the United States so that you can find the right loan for you.

When filling out the enquiry, you only need to provide your personal information along with the amount you need and how long you wish to borrow it. Consider this carefully to ensure that you borrow enough for your circumstances but not too much for your means. The loan request enquiry should only take a few minutes to fill out, and once you have sent it, make sure to stick around to see the results.

You’ll be provided with an instant on-screen decision on your payday loan. It’s also best to remain available via phone or email if a lender wants to ask for some follow-up information.

Am I Eligible for a Payday Loan?

Before you submit a loan enquiry for a payday loan, you should consider whether you meet the conditions necessary. Not everyone is eligible for a payday loan, so be aware of the requirements and stipulations. There are four main conditions to be eligible:

- You must be a U.S. resident.

- You have to be at least 18 years of age.

- You need to have a consistent income with earnings at a minimum of $800 per month.

- You must have a checking account that your payday loan can be deposited into.

Credit ratings have been known to play a big factor in loan approvals, however, our panel of lenders are willing to consider all sorts of credit histories – so don’t be discouraged from completing our loan submission form if your credit rating isn’t perfect!

It’s worth noting that while your credit rating doesn’t have to be perfect, if you’ve struggled with loan repayments in the past (which may have caused damage to your rating) you should carefully consider whether this loan option is right for you, and be confident that you will be able to keep up with repayments.

What Documents Do I Need When Requesting a Loan?

It’s best to keep your bank details and personal information on hand when filling out a loan enquiry to make the process more efficient. This includes your phone number, address, email, and checking account information.

Once you have sent your loan enquiry in, your lender may get in contact to request that you provide some follow-up information. They may ask you to show proof of income or valid identification.

Can I Customize My Payday Loan?

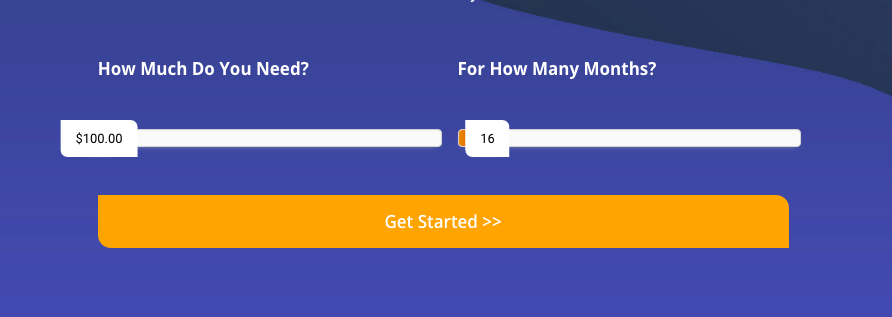

When you submit a loan enquiry for a payday loan with Pheabs, you can select your desired amount and repayment terms.

Think about how much you need to borrow before requesting a loan. Consider the quantity of your income and determine how much you can responsibly repay before accepting a loan.

Read more about what to consider before submitting a form for a payday loan. Your payday loan loan enquiry only takes a few minutes, and if you are approved, you may be able to transfer funds directly to your bank account in as little as one hour!