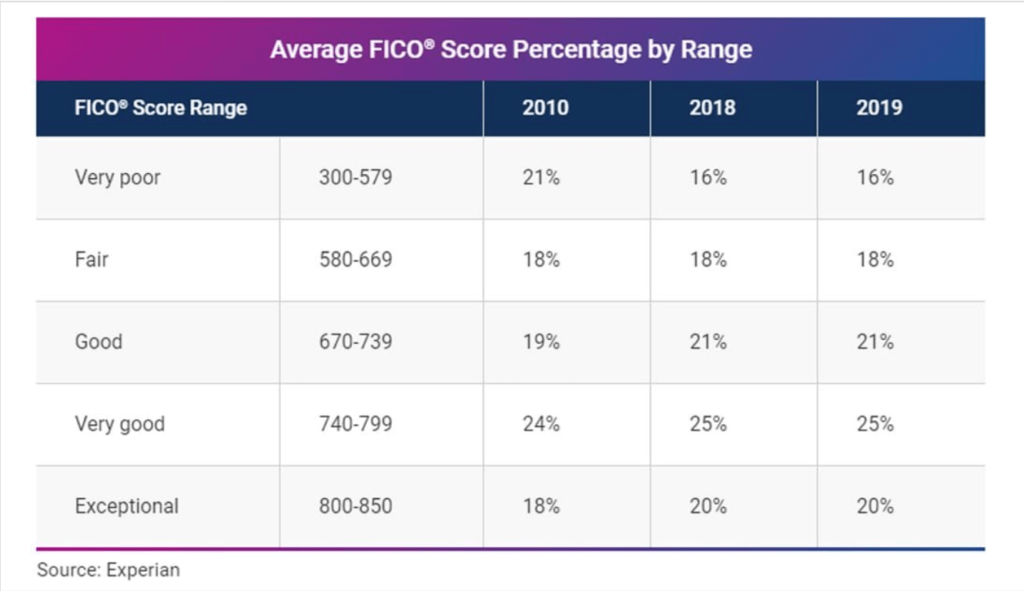

Around 16% of Americans have bad credit, according to data from credit reference bureau, Experian. This means that around 48 million Americans are deemed to have poor credit, equivalent to a FICO score of between 300 to 579.

Bad credit score emerge from being unable to stay on top of your payments for things such as rent, personal loans, credit cards, utilities, cell phones and more. Your credit score is used as an indicator to tell future creditors whether to lend to you or not, and at what terms or rates. By consistently missing repayments and not making regular payments on time, your score can fall and fall and you are said to have ‘bad credit.’

This could make it harder to access affordable finance from well-known banks, credit card companies and lenders – or the interest rate you are charged could be higher to accommodate the potentially greater risk of default.

Further data shows that 18% of individuals have fair credit with FICO scores between 580 and 669 (see 650 credit score loans) and only 1.2% of Americans have perfect credit scores of 850.

Key Points

- 16% of Americans are said to have bad credit, giving them a credit score between 300 and 579

- Having a bad credit score can make it harder to get access to credit, or more expensive

- Around 18% of Americans have fair credit

If 16% of Americans Have Bad Credit, How is Credit Calculated?

Credit scores are calculated through a range of numerical algorithms via the main credit reference bureaus of Transunion, Experian and FICO. The use of numbers makes it very clear and relatable when determining what an individual’s credit score is – and this number can go up or down depending on how well you pay or equally do not repay off any credit or financial products.

The magnitude of your score and how much it goes up or down can depend on the financial product and how severe you have missed payment or how successful your repayment has been for products including:

- Car leasing

- Credit cards

- Loans, including payday loans

- Mortgages

- Utility bills

- Cell phone bills

- Being associated with someone with bad credit (being married or having a joint mortgage)

What Products Are Contributing to Americans Having Bad Credit?

Credit cards – Credit cards are undoubtedly the biggest driver of bad credit in US, with the average American having (x number) of credit cards and generating an average debt of (x number). Credit cards are used for everyday payments, whether it is your daily coffee, grocery shop or purchases for holidays, shoes or clothes. But the ability to make minimum payments, revolve credit and take out new cards with limited checks, allows people to wrack up debt quite easily and subsequently lead to having bad credit.

Loans – Whether it is a personal loan, mortgage, short term loan or payday loan, those who are unable to repay back a loan or miss repayments will cause negative damage to their credit scores – and thus they will need to get into the swing of paying off future loans on time to make their scores improve. It is always important to ensure that you can repay any loans before agreeing to them. Using one loan to pay off another can often lead to bad credit and a spiral of debt.

Car leasing – Buying a new shiny car and updating this every year comes with a price, and with car leasing a very popular option, this requires paying a monthly fee to keep your car on the road. When you add things like road tax and the increasing price of gasoline, this starts to add up, especially if you are trying to look good behind a wheel or have to commute far to work each day.

Everyday bills – Everyday bills can be hard to calculate but can affect your purse strings, especially those bills around the home such as water, electricity, internet, energy, cell phone, cable, gardening and home improvements. If you have a family, there are always high food bills, school related costs and regular entertainment to account for.

What Loan Options Are Available For Americans With Bad Credit?

There are a number of options for people who needs loans for bad credit. Whilst having bad credit typically makes you a higher risk and less likely to be approved, there are many specific lenders and products that specialise in this niche.

To be eligible, you will always need a regular income and employment, since this shows evidence that you should have money coming into your account each month which can be used for loan repayments.

For a typical unsecured loans, such as personal or payday loan, you will need to show that your credit score is improving and that you are making a real effort to make repayments for things such as credit cards and loans on time.

Otherwise, you may look to use a collateral loan to borrow the money you need, which involves taking a valuable asset such as your home or car and using it as security to borrow funds, also known as a title or secured loan.

For those with very bad credit, you can look at using a credit union, which is a charity or non-profit based organisation which allows for borrowing at low rates, however, it may just take a little longer to get access to funds if you need them quickly.

Does Having Bad Credit Mean That You Pay Higher Interest Rates on Loans?

Yes, by having a bad or poor credit score, you are now deemed riskier in the eyes of a bank, card provider or lender – so to allow for the potentially higher chance that you will not repay your loan, the lender says that ‘Yes, we can lend to you, but it will be at a higher rate.”

For example, a typical personal loan could start from around 7% APR for someone with good credit, but be around 35% APR for someone with bad credit.

Furthermore, with bad credit, you may be limited by the amount you can borrow, the duration you can borrow and the type of loan, with less unsecured options and more likely to require a secured loan or title loan to be approved.

How Can You Get Good Credit or Improve Your Credit Score?

Always pay back your loans and payments on time (most important) – The simplest and most effective thing you can do to build up or maintain your credit score is to always make any repayments on-time for loans, credit cards and bills. This constantly shows that you are a safe and reliable person to lend to and will keep your score strong or make it go up. Avoid using minimum payment options for credit cards or arrangements for loans and make a conscious effort to repay on time.

If you have lots of outstanding debts, consider using a debt consolidation loan to combine them all into one loan that can be paid off or speak to a debt professional if you need more advice.

Do not borrow more than you can afford – Whilst it is so easy today to open credit card accounts and apply for loans online, you should ideally limit yourself to what you need. Budgeting is always important to manage how much income and expenditure you need. But taking out too many loans or credit cards can make it seem to a lender that you are living beyond your means and that you can rack up debt quite fast. So with this in mind, close any cards or loans down that you no longer need.

Disassociate from people with bad credit – This doesn’t mean stop speaking to people with bad credit! But if you share a credit card, loan, bank account or mortgage with someone with bad credit, this will be picked up by lenders because they consider you closely linked financially. And hence, you will likely help them out if they need money or are in financial trouble. So if you can afford having joint accounts with someone with bad credit, like a sibling or friend, try to do so.

Check your score regularly – One of the best ways to improve or maintain your score is simply to monitor it. You do not get to see it automatically, but you can request one from the credit reference bureaus (and sometimes for free) or pay a small fee each month to see what your credit score is and how it is changing. The bureaus may even give you suggestions such as paying off certain loans or using credit builder products to boost your score.