Last Updated on April 20th, 2023 at 10:46 am

Young people in America today are enduring more major economic instability than any previous generation. Wages are not enough to cover necessary expenses, and student loans are among the principal factors spurring financial stress. Payday loans have become more appealing to young people as a way to make ends meet before payday. However, payday loans will not solve debt problems but instead likely leave borrowers in a debt cycle.

According to a report by the Federal Reserve, as of 2021, young Americans aged 18 to 29 had an average debt of $14,827, which includes student loans, credit card debt, and car loans, contributing to the overall debt crisis.

Who Is Facing a Debt Crisis?

While many Generation Z members are not old enough to be in college yet, they still experience financial stress covering day-to-day expenses. Many struggle to afford food and transportation, and the worry about future costs of higher education causes anxiety.

A study led by Northwestern Mutual stated that Millennials have $27,900 in debt on average. Generation Z members have an average deficit of $14,700.

Why Are Young Americans Facing a Debt Crisis?

A significant contributor to the financial struggles of young people is the student loan debt crisis. For the first time ever, young Americans who are college graduates with student debt have negative net wealth. A Millennial only has half the net wealth that a Baby Boomer had at the same age.

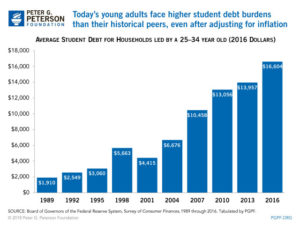

- The number of households with student loan debt doubled from 1998 to 2016.

- One-third of adults aged between 25 to 34 have a student loan.

- Student loans are the prime source of debt for Generation Z.

- As a whole, Millennials make 43 percent less than what Gen X (born between 1965 and 1980) were making in 1995.

- 61 percent of Millennials are not able to cover their necessary costs for three months.

Student debt rise statistics shown between 1989 and 2016. Creator: Eva Conway

Despite having jobs, young people still find themselves having to take out loans to get by. Nowdays, young workers with a college degree and student debt are making the same amount as workers who didn’t have a college degree in 1989.

Students Default on Loans

There are more than nine million student loan borrowers in default.

In February 2020, the outstanding student debt in the USA reached a staggering $1.6 trillion. This has risen from around $830 billion in 2010. This increase means that American student loan debt is now larger than both credit card debt and auto loans. And, these statistics were published before COVID-19 crushed the US economy.

Can Students Use Payday Lending Services?

As a student, you have access to a wide range of finance options to support you during your studies. You may consider student loans, grants, bursaries and credit cards. If you are a student facing a financial emergency such as car repairs or hospital bills, you can apply for a payday loan if you meet the criteria.

However, at Pheabs, we do not encourage payday lending to students, since this is a high-cost form of credit. If you’re a student in need of some extra cash, there are safer alternatives you should think about. Think carefully before agreeing to a student payday loan. Payday loans should always be looked upon as a last resort. Make sure you have exhausted all other efforts to find the funds you need before submitting an enquiry.

Payday Lenders Target Young People

Unsurprisingly, payday lenders take advantage of young American’s debt crisis. They focus on technology because young people have the highest tech usage.

Young people are the largest group who use apps for their finances. 48 percent of those aged 18 to 24 use mobile banking apps regularly. 35 percent of those aged 25 to 34 also manage their finances from their phone. Popular apps and websites are so successful amongst young Americans and new app-based short-term loan services aim to target this profitable market.

These loan apps capture young people’s attention with commercials that assure, “Get paid the instant you leave work.” Regulators are concerned that some of these apps are operating as illegal payday lenders.

What Is the Outcome for Young People?

Young people today endure substantially more financial pressures compared to previous generations. However, turning to payday loans will not solve their debt problems but instead likely leave them in a dangerous debt cycle.

If you take out a payday loan to help cover daily expenses but cannot meet a payday loan repayment on time, your credit rating may be affected. Bad credit means that you are less likely to be accepted for loan products in the future.

Can I Repay Student Debt With a Payday Loan?

You should not used a payday loan to repay your student loan debt. This is likely to create a cycle of debt with high fees that will be detrimental to your financial situation. If you have fail to meet payments on time, your loan continues to gather extra interest. You will likely amount a great deal of unmanageable debt which, if you do not repay, could end up marking your credit record as well as other consequences. It may mean that you can no longer get credit products from traditional cash service resources. Your lender may also choose to enforce wage garnishment, lawsuits, and debt collection.

We do not encourage payday lending to students, since this is a high-cost form of credit. If you’re a student in need of some extra cash, our guide Are Payday Loans Suitable For Students? will help you work out if a payday loan is right for you.