Last Updated on February 29th, 2024 at 09:28 am

You should typically only have one or two payday loans open at one point – this is to avoid being overdependent on high cost financial products and potentially falling into a spiral of debt.

There is also a rule about whether you can have more than one payday loan open in a particular state. But whether you are in Ohio, Florida, Illinois, California or Texas, you should only be able to get one or two loans open at any point. This is the same rule whether it is from a store or payday loans online.

| State | Number of Payday Loans You Can Have Open |

| Alabama | 1 |

| California | 1 |

| Colorado | Unlimited |

| Florida | 1 |

| Iowa | 2 |

| Maryland | 0 |

| Illinois | 0 |

| Nevada | Unlimited |

| Ohio | 1 |

| Tennessee | 1 |

| Texas | Unlimited |

How Many Loans Can You Have At Once?

You should be limited to one or two payday loans outstanding or open at any time. Payday loans are expensive and getting too many can be dangerous – hence it is a state law or enforced by regulation. If you need to borrow more money, consider alternatives such as paying off debt, using a credit union, selling your other personal items or budgeting more carefully.

Why Can You Not Have More Than One Payday Loan Open At One Time?

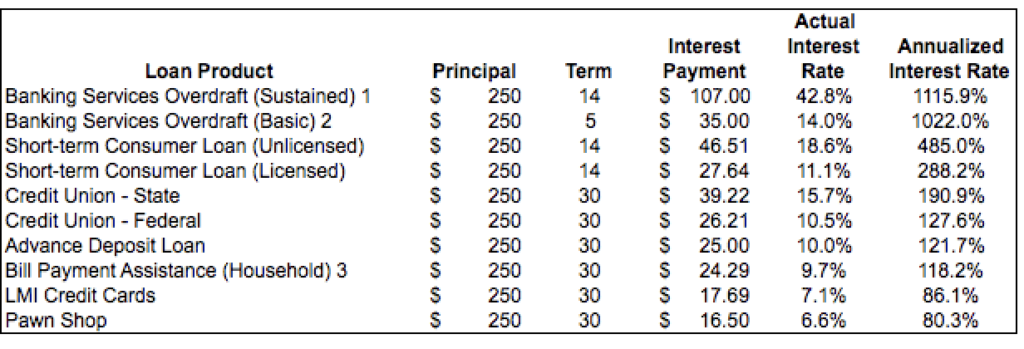

There is a good reason why you should not have more than one payday loan open. The APR of payday loans is around 400% to 600% which is a very high rate when compared to other financial products such as title loans, mortgages, credit cards, credit unions or personal loans.

The third and fourth one down: Payday loans are fast, convenient and short-term, hence their rates are higher than most other products

By taking out too many payday loans at once, this could make it hard to repay out of your pay cheque each month. Payday loans become dangerous when there are late fees involves and added interest – and this is when the cost of a loan really starts to add up.

Not to mention that missing repayment can negatively impact your credit score, making it harder to access similar loans and other forms of credit in the future – and even some essential things like a cell phone, being able to rent an apartment or get a mortgage.

Therefore, according to the regulation of each state, it is typically just one loan that you are allowed (such as Florida, Ohio, California) and some have unlimited (such as Texas and Nevada).

How Many Payday Loans Can You Get in Florida, Ohio, California?

You are allowed to have only one payday loan open in the states of Florida, Ohio and California at one time.

Are There States Where You Can Get Unlimited Payday Loans?

Yes, currently Colorado, Texas and Nevada offer unlimited payday loans for a customer, so in theory you could take out 3, 5 or 10 if you wanted to.

However, this is not recommended. It is the same practice in the UK and there have been horror stories of people who took out 10 or 15 payday loans and fell into horrendous debt as a result. (Source)

You can get unlimited payday loans if you live in the state of Texas, but this is not advised

Payday loans are intended to be for short-term use only, simply to tide you over until your next payday from work. In fact, your loans should be repaid within a couple of weeks or months, to pay for an emergency expense, whether it is a car repair, medical bill or household expense. Ideally they are not used for repeat use and you should avoid having to use them again and again.

What Should I Do if I Need More Than One Payday Loan?

If you need more than one payday loan, this is not the worse thing in the world, but you want to avoid falling into this potentially expensive trap.

Consider borrowing money from family and friends, since this is always going to be interest-free and with very loose payment terms. You can simply pay back when you are up to date with your other expenses and feel that you are back on your feet.

If you need to borrow more money, you could look at even closing down your existing payday loan, so paying it off early and then looking for a larger loan amount, whether it is through a credit union which offers much lower rates, using a secured loan or selling every items around the house that you do not use.

From old books, CDs and even clothes, you have access to a number of apps and garage sales and could easily put together $300 or $500 which is pretty much the typical payday loan amount anyway. So go into the basement or the loft space and find some old gems that you don’t need anymore and this could be a viable solution to your payday puzzle.

Otherwise, you can always look at budgeting more carefully if you find that you are in the same payday cycle each month. Could you do your grocery shopping more effectively? Could you and your partner share a car for a couple of months? Is it worth asking for some relatives for some hand-me-downs for your kids in toys or clothes? There are a number of simple ways to save money around the house and avoid using high cost loans instead.