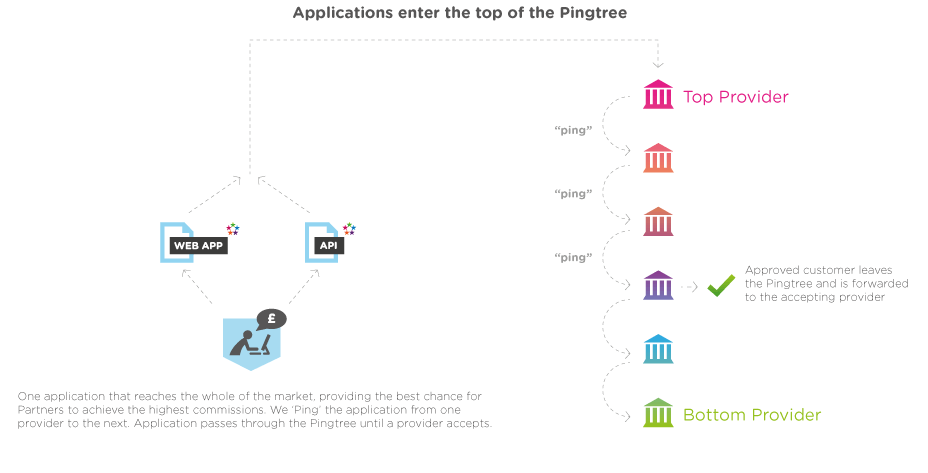

A loan pingtree is a type of engine or software which is used to process a borrower’s live application and send it to numerous lenders at once and ultimately sell it to the highest bidder.

In short, it is a very effective way for affiliates to sell their leads and earn commission – and also for lenders to purchase quality leads at bulk and at affordable prices.

Do you have questions about pingtrees? Get in touch with me here.

The idea is that a loan application comes into the system and essentially ‘pings’ every lender down the ‘tree’ until it is sold at the best price. This is a very popular tool used in the payday loans industry and it has been flourishing for over a decade across the US, UK and Australia to name a few.

The pingtrees are owned by brokers or intermediaries who essentially on-board different lenders onto their system. Once an application comes in, the customer’s details such as age, credit score, income and loan requirements are presented to multiple lenders at once, maybe 10, 50 or even 100 lenders.

If a lender likes the customer’s criteria, they automatically bid for it and it is sold to the highest bidder, which could be anywhere from $0.01 for very low quality or $250 for the best quality.

At a Glance

- Pingtrees are a software that allows customer loan applications to be sold to lenders in real-time

- They are common for the payday loans industry, with more than 50 lenders per pingtree

- Applications are sent down the tree and they ‘ping’ the lender one-by-one

- Brokers can place pingtrees on their websites through iFrames or APIs

- Good applications can be sold for up to $250, with bad credit customers starting from just $0.01

How Do Loan Pingtrees Work?

Step 1: A borrower applies on a website where there is a pingtree – they may be looking to borrow $500 or a similar payday loan amount.

Step 2: Their loan application goes through a pingtree and is processed instantly in real-time, potentially connecting them to multiple private lenders, banks, credit card companies, apps and credit unions.

Step 3: The borrower has good credit and their lead has been sold for $50. The company who owns the pingtree receives 10% commission ($5) and the owner of the website receives 90% commission ($45) for generating the original lead. The lender has paid $50 for this lead and hopes to fund the customer and generate a profit by charging the customer interest.

Loan Pingtree Example

How Do Loan Pingtrees Work for Lenders?

For private lenders and payday loans companies, they often use pingtrees to buy massive amounts of leads. It is an efficient process which is connected via an API so they can include their risk and credit criteria and update this on a regular basis if they need to.

The lender can determine their price points with the broker who owns the pingtree and agree to a daily, weekly or monthly budget. It is not uncommon for a lender to buy $10,000 or $100,000 worth of leads per month – and this should be measurable for them, since they know that this should relate to potentially 1000 or 100,000 good qualified leads, with the right criteria, which they are ready to fund.

For lenders, buying leads is a fast and cost-effective way to generate traffic – and can be better than alternatives such as PPC, SEO, emails, direct mailers, cold calling, TV and other expensive marketing methods.

How Do Loan Pingtrees Work for Affiliates and Brokers?

As an affiliate, you can create your own website that offers loans and you can simply embed one of the broker’s form and start earning commission as soon as borrowers start filling in applications. A lot of forms are just iFrame or JSON files which can literally be copied and pasted into your website. Some forms are a bit more advanced and may require integration via API.

As an affiliate, you would sign up with affiliates such as StopGo, Dot818, Zero Parallel and Leads Market and in addition to getting a live form, you will also be able to track your results and commissions in real-time using a reporting dashboard and login.

How Does The Integration Work for Loan Pingtrees?

There is the original pingtree owner or broker who starts out the process. They are able to integrate lenders and their requirements using APIs.

But for affiliates, this is usually just an iFrame which can be copied and pasted onto your application form page – see some examples below:

How Do Brokers Get Leads to Their Loan Pingtree?

There are a number of ways that brokers or affiliates can generate traffic to their website. However, it is always important to check that you are doing this legally and not stealing or re-using data without permission. Popular methods include:

SEO – This is search engine optimisation, the techniques used to climb up Google’s search results through a number of techniques including content, link building and technical expertise. This can take a few months to materialize but can often be regarded as very high quality traffic.

PPC – This refers to pay-per-click advertising and paying for ads on search engines such as Google. There is strict regulation surrounding the terms of payday loans, so using other phrases relating to loans and borrowing money are the types of keywords you would have to bid on.

Affiliate – You can use other affiliate channels and methods to generate loan applications and traffic, whether it is through placements on third party websites, promotions or offers.

Direct mailers – Sending out flyers or promotions in the post is another way to attract traffic and applications to your website – although this is rarely the first port of call for a marketing campaign.

Email marketing – Very popular in the US, this involves purchasing email addresses and sending out emails offering your loan services. The quality is not always the best, but it has huge scalability.

The Pros of Loan Pingtrees

There are a certainly a lot of benefits of using pingtrees. Notably, for the lender, it is an effective way to narrow down the kind of traffic that you want, adjust your risk requirements and change your budgets quite easily. For some of the US and UK’s largest lenders, they have used pingtrees as their main form of lead generation and growth.

For affiliates, using pingtrees is a quick and highly effective way to monetise your traffic, often earning for every single application that you generate. It can be a very profitable business if executed well.

For customers and borrowers, they are able to get an instant decision when looking for a loan and are almost always going to get a loan offer. If they have good credit, they will be recommended to a lender with very favorable terms. But even if they have a bad credit score and their loan application is not worth much, there are always buyers at the bottom of the tree, who might offer them a credit card, a credit union loan or alternative product such as a title loan.

The Cons of Loan Pingtrees

The negatives of loan pingtrees are probably more for the borrower. Whilst they have the opportunity to get approved for a loan, there are some downsides, such as being offered a higher rate (since it is sold to the highest bidder), not realising that the borrower could actually get much lower rates elsewhere. Plus, when an application is reviewed by multiple lenders, it can undergo multiple soft credit searches and whilst this is not damaging long-term, it can have a short-term disadvantage since having too many credit searches can make a customer look desperate.

For borrowers, they trust that the broker and pingtree they use will keep their details safe, but often it is not easy to see what is a pingtree and what is a basic form for a lender. In many cases, certainly in the UK, customers have had their details shared and shared again and this has results in being bombarded by emails, text messages and phone calls – something that that regulators have been working hard to overcome.

Whilst not a huge problem, for affiliates that use pingtrees, there is always the danger that they can be earning more elsewhere with different partners. Some lenders who pay good rates only work with some pingtrees and there is always a risk that the grass is greener elsewhere.

How Do You Get The Highest Commissions Through Loan Pingtrees?

To earn commissions of $50, $100 or $250 per application, as an affiliate, you are more likely to find these customers if they have good credit scores, stable incomes and homeowner statuses.

In addition, you ideally need to find candidates who have never been in the pingtree system before, since this will present them as being fresh and likely be sold to a lender for a higher amount.

With the majority of applications are sold for just $0.10, you need to find good customers and good traffic to make it worthwhile.

Is An Application Always Sold?

Yes, pretty much every application is sold through a pingtree, with the highest bidders attracted to good customers with good credit and strong profiles.

On the lower end, even those with very bad credit can be offered products by credit unions or title loan companies who provide finance secured against your car. At the bottom of the tree are also companies that offer debt help, debt management or ways to consolidate your debts – so whilst not directly offering a loan, they are providing ways to improve their financial situation.

So Are Pingtrees Good for The Customer?

Certainly if you have bad credit or have been looking for a loan and are struggling to be approved, a pingtree could present your requirements to more than 50 lenders in one go and very possibly give you a loan offer or quote.

However, if you have good credit or are considered to be a good borrower, you may be better going direct to a bank or private lender who can offer you rates lower than 36% APR, or even better, borrowing from family and friends with no interest at all.