The APR for payday loans is high because it compounds a product over a year, which only truly lasts a few weeks. This already inflates a very high interest rate which is more than the average personal loan to cover the transaction fees, the fact that it is unsecured and there is a higher default rate than other types of loans (around 15-20%). Put these all together and you get a payday loan APR which is around 400% to 500% in the US and around 1,000% in the UK.

What is the Average Rate of APR for Payday Loans?

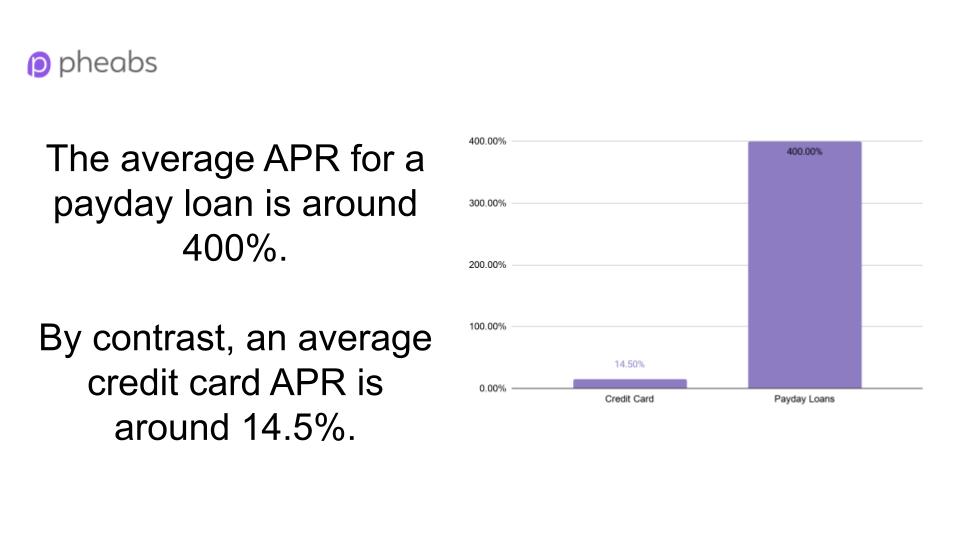

Payday loans are renowned for having one of the highest APR rates. Depending on the lender, these tend to average out at around 400% (around $15 to $30 per $100 borrowed). By contrast, APRs on credit cards can range from between 12% to about 30%.

Why is the APR for Payday Loans Higher Than Average?

APR for payday loans is notoriously high. But why is that? There are a few key reasons why payday loan lenders are able to charge sky-high APR.

Payday Loans are Unsecured

Payday loans are unsecured meaning that every time a lender agrees to a payday loan, they are putting themselves at risk. Secured loans refer to loans which are supported by collateral meaning that if a borrower is unable to repay the loan, the lender can repossess financial assets. Payday loans do not have this supporting collateral.

The Payday Loan Profile is Unstable

Looking at the demographics of a typical payday loan user, they do not have an exemplary financial track record. Thus, they are high risk borrowers who cannot guarantee repayment. Therefore, borrowers need to make demands in other forms as a guarantor i.e. high APR.

Payday Loans are Designed for People with Bad Credit

Payday loans are one of the few available options for those with bad credit. Most financial institutions and banks refuse to loan money to this type of borrower. As such, when lending to those with bad credit, lenders are in a position to demand more interest as they are at a higher risk of no repayment.

Payday Loans are Short-Term

Typically, payday loans are for a few weeks only. As APR is calculated on an annual basis, it means multiplying a weekly figure by 12 or more. Subsequently, it is easy for the APR to reach 3 figures.

Payday Loans Are Often Not Repaid

More than any other type of loan, payday loans are often not paid back by the borrower. Around 15%-20% of borrowers are unable to repay their payday loans at the end of a term. Similarly, 1 in 4 payday loans are re-borrowed at least 9 times, if not more (according to the Consumer Financial Protection Bureau). As such, the lender needs to have a high APR to cover them.

Payday Loans are Expensive

The short-term and high-risk nature of payday loans makes them expensive. If someone wants to borrow $200 for two weeks, 5% of the loan is $10. If you are working on the assumption that a lending fee is an annual charge, the interest rate needs to be rolled over 26 times (annual rate). That is already a 130% APR before any other costs.

APR Supplements Running Costs

All fees incurred by the lenders make up part of the total APR. These may include the operating costs of a payday loan store, employees, running credit checks or the logistics behind instant payments. For every $100 they repay, a percentage of this covers the operational costs.

What is an APR?

APR (annual percentage rate) is the annual rate of interest borrowers pay to investors when they take out a loan. APR is expressed as a percentage and works as an annual percentage, regardless of the duration of the loan. The APR represents the annual cost of funds for a lender and the lender has the power to choose what fees are included or excluded.

What is Cost of Funds for Payday Loans and Why is it Important?

The cost of funds is one of the most important factors for a financial institution when lending money – it is how much they must pay in order to obtain funds. A lower cost of funds means a greater return when lending money. Subsequently, the difference between the cost of funds and the APR incurred by borrowers is one of the main sources of profit for many financial institutions.

How Does APR Work for Payday Loans?

An annual percentage rate is expressed as an interest rate, based on what percentage you would pay annually if taking other costs into account. APR accounts for the annual rate of interest paid on investments but does not account for any compounding of interest within that year.

How Payday Loan Interest Rates are Calculated for Payday Loans

The APR for a payday loan is calculated by dividing the amount of interest paid by the amount of money borrowed. Then, this figure is multiplied by 365 to represent the annual rate. Then, that figure is divided by the length of repayment term and multiplied by 100.

What is the Maximum APR for Payday Loans?

Shorter term loans typically incur higher APRs which can be around 390-780% APR. Many states in the United States have a cap in place for APR rate. However, for those states without a cap, rates are typically higher.

Why is APR Used as a Measure for Payday Loans?

APR is used as an official measure to compare different financial products. Subsequently, rates (including those for loans, mortgages, car finance) are presented in the form of APR. This is an especially useful way of understanding long-term financial products.

Are There Other Important Metrics for Payday Loans?

The APR is one of the most widely used measures when comparing different loans. For payday loans, however, it is also worth looking at the cost per daily interest, especially as these loans tend to be short term. Borrowers are also encouraged to look at the cost per $100 borrowed.