Only 14% of people who take out payday loans are able to repay them. Payday loan borrowers are notorious in the sector for being unable to repay their loans yet the sector is ever-growing with around $9 billion paid out in payday loan fees annually.

How Many Borrowers Are Unable to Repay Their Payday Loans?

Statistics suggest that only 14% of payday loan borrowers are able to repay their loans. Subsequently, repeat borrowing rates are very high with 1 in 4 payday loans rolled over or re-borrowed at least 9 times.

Why Are People Unable to Repay Payday Loans?

Despite being advertised for emergency unexpected paychecks between payments, 7 in 10 payday loan borrowers are relying on them to cover regular monthly payments such as rent and utilities. Thus, if they are relying on these loans to cover their basic costs, their income is evidently not high enough for their basic living expenses. Below is a list of some common reasons why people may be unable to repay their payday loans:

- A lack of money.

- Bad credit.

- Busy paying off other loans.

- Typically in debt.

- Have a low income.

- Are bad candidates for loan repayments.

- Unable to afford payday loans.

- Struggling with sky-high APR.

Payday Loan Users Lack Money

The average payday loan user lacks funds in general, with 58% of payday loan borrowers struggling to meet monthly expenses. The typical profile is a low-income, unemployed or heavily indebted individual.

Bad Credit

Payday loan users typically have poor or bad credit ratings which is why they are unable to secure loans from traditional lenders. Their bad credit implies that they are not able to meet a specified repayment plan.

Paying Off Other Loans

Many payday loan borrowers are already paying back other loans. In fact, 80% of payday loans are taken out within 2 weeks of paying off a previous payday loan. Additionally, three quarters of payday loans are taken out by someone who has already used them.

Payday Loan Users Are In Debt

The typical payday borrower is in debt five months out of the year, not least due to the repeat borrowing or the fact that they are already in debt before they take out the loan.

Low Income

Many of those looking to take out a payday loan are in a low-income bracket, with an average annual income of $30,000. Therefore, they struggle to meet their monthly expenses even before having to repay a loan.

Bad Candidate For Loan Repayment

There is a reason that many payday loan borrowers can not secure loans from traditional financial institutions and banks and that is due to their high-risk profile. As such, one of the risks incurred by lenders when providing payday loans is the likelihood that borrowers will be unable to repay their loans.

Payday Loans are Unaffordable for Most Borrowers

By nature, payday loans are unaffordable for many. The average payday loan requires a repayment of $430, which represents around 36% of an average borrowers paycheck. In fact, research suggests the majority of borrowers can only afford a repayment of 5% of their paycheck in order to cover their basic expenses.

Sky-High APR

The average annual percentage interest rate (APR) for payday loans is around 400%. By contrast, a “high” APR for a credit card is around 30%. The high-risk nature of these types of loans means that lenders charge a far higher interest rate than traditional lenders. Lenders do not need to charge on a price-competitive basis; instead, they charge the maximum rate permitted under state law.

How Many People Are Relying on Payday Loans?

The problem is deep-rooted with so many Americans relying on payday loans each year. As many as 12 million Americans take out a payday loan annually and latest statistics suggest nearly 14,500 payday loan stores across the United States.

Why Do So Many People Rely on Payday Loans?

For millions of Americans, payday loans are the only way to access credit. Approximately ¼ of US households do not have an account with a financial institution. This is due to the huge proportion of those who are low-income, a situation which has worsened since the coronavirus pandemic.

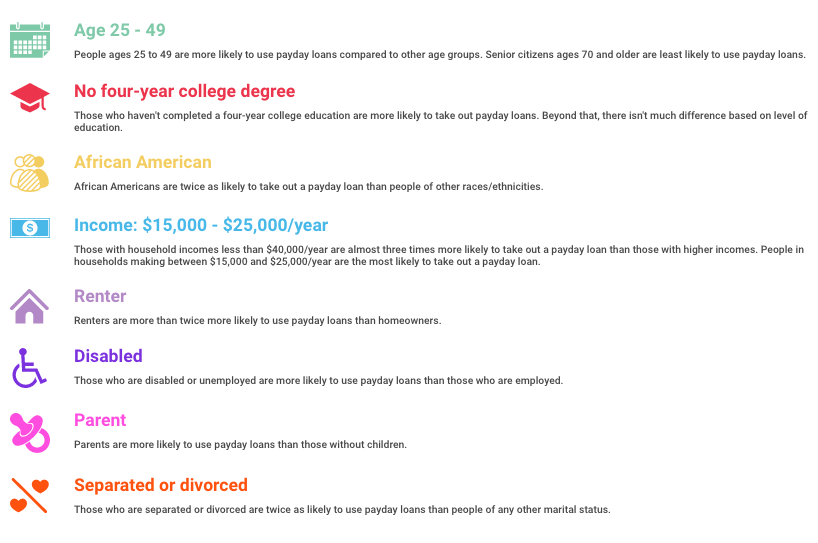

Who Is Using Payday Loans?

Payday loan users are cross-generational and cross-cultural. However, there are a few key trends. Millennials and Gen-Xers are the age group most likely to use these types of loans. Additionally, those without a four-year college degree, renters, those who are separated or divorced, African Americans and those with an annual income of less than $40,000.

What Happens When Borrowers Cannot Repay?

When borrowers cannot repay their payday loans, that is when they enter financial problems as they juggle repayment alongside their other financial obligations. This is why so many payday loan borrowers are repeat borrowers.

If borrowers are unable to repay the loan within the agreed time frame, a lender is entitled to charge additional fees for re-borrowing or rolling over the debt.