More than 90% of motorists purchase their vehicles through car finance and this usually involves paying a deposit and then monthly repayments until the debts are cleared and you finally own the car. But the reality is that car finance deals are not always transparent and the same across the market. There are several factors that can help you get a better rate such as using price comparisons, negotiating hard and even the time of month that you buy from the dealer.

Dealerships have sales targets to meet, and timing your purchase could result in a great deal. You can also lower the overall price by making a higher deposit or trading in your existing car. Shopping around for car finance deals can help you find the best rates, and choosing certain car types and specifications could lead to a cheaper or lower-priced vehicle.

“The price of car finance and the rates charged by dealerships can really vary from place-to-place. Consider getting multiple quotes and haggle down the price. There are always additional add-ons like warranties and servicing that can be thrown in and also don’t be shy to ask about their targets, since enquiring just before a target deadline could really help bring the price down.”

Daniel, founder of Pheabs:

1. Time It Right – You Could Save 10% To 20%

Strategically timing the purchase of your car can save you a lot of money. When considering which dealership you are buying from, think about key dates for them. Dealers typically work on a quarterly basis with specific targets. Purchasing a car towards the end of the quarter may mean that you get lucky with a deal as dealers are usually more willing to lower the prices. With that in mind, the end of March, June, September and December tend to be the best times for seeking competitive rates.

2. Buy Pre-reg Cars – Save Up to 70%

Purchasing a pre-reg car can save you up to 70%. A pre-reg classification signifies that the vehicles were purchased by the car dealership within the last six months and are classified as used despite being completely new. The same applies for cars used for test driving and in showrooms. They are brand new and have never been owned, yet, at a technical level, they are “used” which automatically renders them cheaper.

3. Higher Deposit, Lower Price

As with any type of financing, the higher the initial deposit means lower monthly payments. By putting in the maximum deposit that you can afford, you will own more of the car and thus be able to pay off cheaper monthly installments and have a more manageable payment plan.

Your large deposit can also be offset by trading in a car with a greater value, compared to not trading in anything at all. But bear in mind that dealers will always buy used cars at a lower rate, since you are paying a premium for the convenience. If you can sell your car for a higher amount than the dealer offers you can do that and apply the sale proceeds to your deposit and thus borrow less (it can be dangerous when people roll over the balloon payment to a new contract).

4. Do Your Research

Doing your homework before visiting a dealership, either by using a specialised broker or a price comparison site, ensures that you are not going into a negotiation totally blind.

These services give you access to multiple finance options in one place so that you have a better idea of market rates and what type of financing can be secured. This, in turn, will help you in a negotiation process and make sure that you are asking the right kind of questions to the dealer.

PCP (Personal Contract Purchase) is used by 90% of motorists because it is technically the cheapest way to get on the road, but it is not always the most sensible long-term, since you will need to make a large balloon payment at the end of the contract if you eventually want to own the vehicle outright . You should also consider other forms of car finance such as hire purchase or leasing.

5.A Better Credit Score for Better Rates

In general, as with most loans, a better credit score can lead to a better rate for your car finance as lenders consider you to have a better borrower profile and a successful track history of repayment. Your earnings and existing loans, such as mortgages and credit card bills, may also affect the rate of your car finance quoted.

For those with little to no credit history seeking car finance, or for those with a bad credit score, taking a look at your finances could help you hugely in the future. Consider closing down any credit cards or store cards that you do not use – or paying off any bills or outstanding debts, since these can help build up or improve your credit score.

6. Part-Exchange Your Vehicle

Opting to part-exchange your existing vehicle can help with the purchase of your new car. Ideally, your vehicle should be in a good condition, so before choosing this option make sure to fix up any small scratches or dents that could knock down the price. Again, If you can sell your car for a higher amount than the dealer offers you can do that and apply the sale proceeds to your deposit and thus borrow less.

The dealer will buy your old car at a less favourable rate, since they are taking it off your hands. If you feel it has been undervalued, you could always try sell your car independently through adverts, word-of-mouth or taking out an ad in a magazine or local newspaper.

7. Opt For Cheaper Specifications

Depending on your needs, choosing particular specifications will help make your car purchase cheaper – since all the additional features can come with a cost – and also increase the price of your insurance.

Also, avoid things like:

- Spoilers

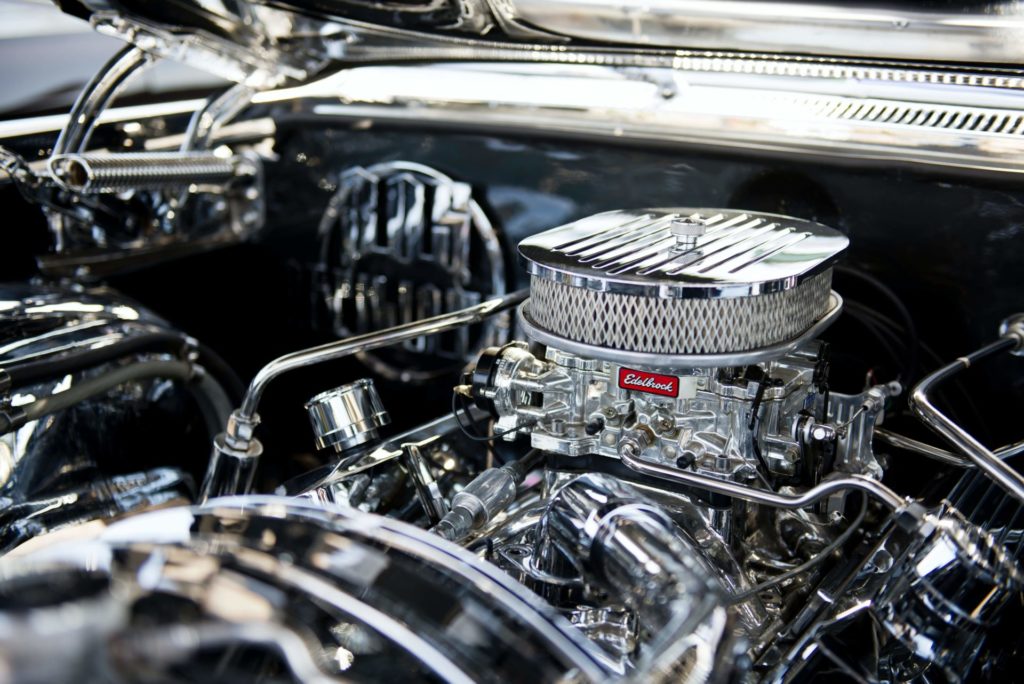

- Large engines

- Paint or colour jobs

- Modifications including spoilers or turbocharged engines

8. Repay Your Car Finance Early

If you can afford it, consider paying off your car finance as early as possible. The longer the borrowing period, the more accumulated interest you will have. By paying this off early, you will have less interest to pay and you can own your vehicle earlier than planned.

Before doing this, you will need to check the terms of your lending agreements as certain lenders charge an early repayment fee (settlement fee). However, sometimes these are very low and it is worth it to prevent building up more interest.

If you cannot afford to pay off the whole thing, you could make overpayments or pay large chunks and this could help ease the overall financial burden. But do make sure your lender will properly reduce your debt each time when calculating interest.

9. Don’t Be Afraid to Haggle

When visiting a dealership, negotiation and haggling is par for the course. Never accept the first offer as this can always be inflated.

Expert negotiation tips include going in at a much lower price than the asking price, visiting multiple dealerships to compare and contrast, and do your homework first to know the real market value of what you are looking at. Even just calling up dealerships for some quotes can be a good way to shop around without visiting the premises. But don’t go with the first offer. Get multiple quotes before committing.

10. Continue to Seek the Best Offers on Extra Bits

Simply because you have chosen your car, does not mean the negotiation ends there. Warranties, servicing and certain types of insurance are all negotiable. The dealership may try and sell you additional features or products like GAP insurance (these are called “upsells” which you may not need or will be significantly cheaper elsewhere or online. When visiting your dealership for any service, remember that the prices can be negotiated!