When you die, your debts such as mortgages and credit cards are passed onto your estate and they should typically be paid in an orderly fashion.

When you create a will, you will nominate an executor to carry out your affairs when you die. This person is typically a spouse or a child and they will be responsible for making sure that your debts are paid off – and also distributing anything that you leave to people and loved ones such as heirlooms or personal belongings.

Whilst outstanding debt can be very stressful for your loved ones to manage and organize, there are a number of steps that can be taken to make this process smoother. In this guide, Pheabs highlights who is responsible, the debt in order of importance and how to get debt collectors to stop hassling you.

What Does Your Estate Consist of?

Your estate is all the money that you have left over when you die, which is passed onto loved ones as inheritance or indeed, used to pay off outstanding bills. This includes any savings, retirement funds, pensions, personable belongings, passive income, collectibles, value of your house, boats, bikes and cars (after all interest paid off).

Typically anything left over after all your debts are paid is bequeathed as inheritance to your loved ones and this is distributed by the executor.

Key Points

- When you die, your outstanding debt is handled by your estate, which refers to any money that you have left over when you pass away

- Your executor is responsible for paying off all your debts and passing on any inheritance and personal valuables to other loved ones in your will

- It is your estate, not your loved ones who need to pay back the debt. Your spouse or children should not be pressured into paying back debt to major organizations and there are ways to stop collectors from contacting you too much

Who is Responsible For Someone’s Debt When They Die?

The executor of your will is responsible for someone’s debt when they die. This is someone close to you and is agreed in your will, which could be:

- Spouse

- Sibling

- Child

- Grandchild

- Parent

- Close friend

- Member of the community

The executor will make all the payments on the individual’s behalf. No money is automatically or taken without their knowledge, they are in control of what gets paid.

Is a Spouse Automatically Responsible For Someone’s Debt When They Die?

Whilst a spouse is likely to be an executor responsible for dealing with your debts, they are not personally required to pay off debts out of their pocket.

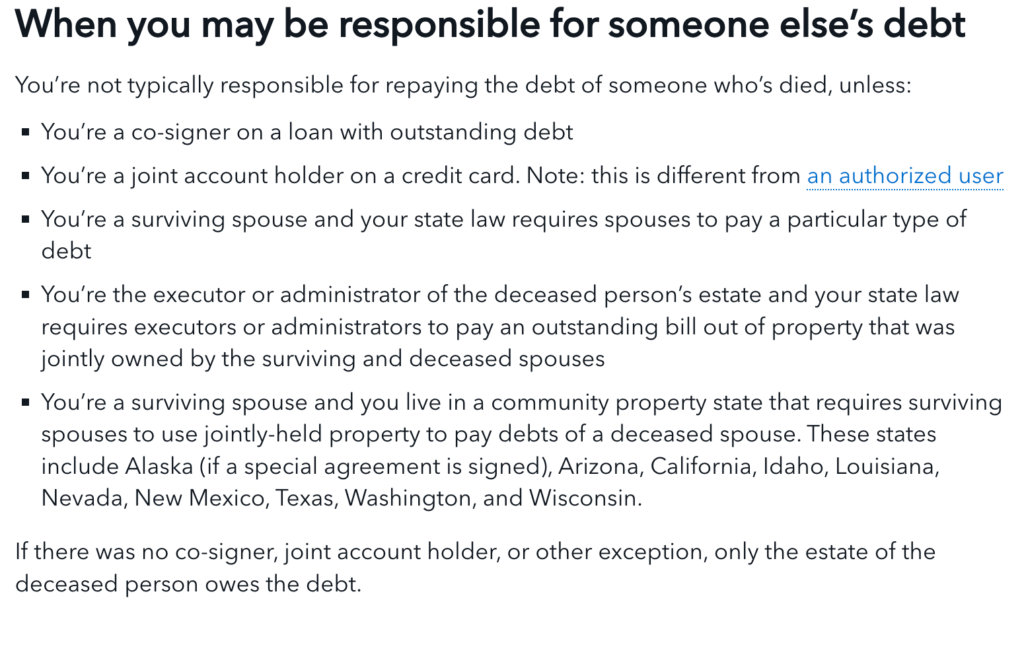

However, there are 9 US states where debts are shared and this is known as ‘community property states’ and is applicable in Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington and Wisconsin. If you fall under this category, spouses will be responsible for their partner’s debt when they die.

However, generally speaking, if the financial agreement for a credit card, personal loan, car or mortgage is in your personal name and you die, this is therefore the responsibility of you and your personal estate.

If your spouse has any joint accounts or agreements, this debt will therefore be passed onto them. And this is quite common too, for things like joint credit cards, car loans and mortgages. Assuming the spouse is still alive, the accounts will continue to be paid as normal.

Who Pays For My House When I Die?

When you die, the payments for your mortgage on your house or apartment will continue to be paid by your spouse, children or from your estate.

If interest is still due each month for your mortgage, these payments will continue to be paid by your spouse if they are still alive and wish to live there. Or perhaps if the children want to purchase the house, they will be responsible for ongoing payments.

Additionally, it may come out of your estate, whereby the house could be sold to cover all outstanding and if there is money leftover, this is passed on as inheritance.

What Debt Might You Be Responsible For When Someone Dies?

- Anything with a joint account or something that you have co-signed, including properties, mortgages, personal loans, credit cards, car loans. If these are just in the deceased’s name, it is not your responsibility.

- Community property estates – in 9 US states (Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington and Wisconsin), there are laws that means that a spouse is legally responsible for any debts, including student loans. If this is something that you agreed to, you may be required to cover their debts if you were married.

- Personal debt – if your loved one personally owed money to someone and there was no contract, this is something you may be responsible for.

Source: https://www.consumerfinance.gov/

What Debt Are You Not Responsible For When Someone Dies?

- Anything in the individual’s name including student loans, medical debt, home equity loans, payday loans, secured loans, unsecured loans, credit cards and more.

Which Debts Take Priority When Someone Dies?

An individual accumulates a number of different debts throughout their lifetime and when someone dies, the finances are repaid in order of importance:

Medical Bills (Most important)

In most US states, medical bills take priority in the probate process, especially if you have been receiving Medicaid from the age of 55. This can be complicated and you may wish to consult an attorney if you need assistance.

Home Equity Loans

When you borrow money against your home, the lender can force the individual or estate to pay back the money immediately, dead or alive. For some this might involve just paying back the outstanding interest or having to sell the property to cover it.

Secured Loans/Mortgages

Monthly payments for mortgages for your house or apartment still need to be paid. The payment for the entire property does not need to be paid in full, just the monthly amount and this could be kept up by the spouse or children. You may request a payment holiday from the bank or lender if this helps you get things in order with no added fees or impact to your credit score.

Credit Cards and Unsecured Loans

Any individual credit cards and unsecured loans, such as personal or installment loans with bad credit, will be repaid via the estate. Any joint or co-signed loans or credit cards will be subject to spouse or life partner to continue making payments.

Car Loans

Similar to above, any individual accounts will need to be paid for by the estate and if you have a joint agreement with the deceased person, the payments will need to be kept up or the car can be repossessed if no payments are made for some time.

Student Loans (Least important)

Federal student loan debt is typically written off when a person dies, but private student loans are still covered by the individual’s estate. If there is not enough in the estate, it will go unpaid.

What Finances Cannot Be Touched By an Estate or Debt Collectors?

- Life insurance payouts

- Retirement accounts and pensions

- Living trusts

If you have taken out life insurance, this can provide a sum to pay off your mortgage and other debts (depending on its value) and this can certainly help cover some debts.

You can also have your retirement funds and pensions and these savings are used to fund your lifestyle and can be used to pay off debts, they cannot be automatically taken without the executor.

Can I Get Debt Collectors To Stop Contacting Me Over The Debt of a Deceased Person?

Under the Fair Debt Collection Practices Act (FDCPA), debt collectors may not harass, oppress, or abuse you or any third parties they contact, such as spouses or children. Even if you are responsible for the debt, they do not have the right to harass you.

You can ask them to stop contacting you but sending a simple phone call or email is not enough, explains Consumer.FTC.Gov. You should instead send a full letter and confirm receipt that they will stop contacting you and mention that you will take specific action like filing a lawsuit if they do not stop.

Importance of Estate Planning, Life Insurance and Wills

Being organized with your debts is essential before you die. Whether you have a full list of all your outstanding debts, the providers and amounts due and making sure that your spouse and executor has all the information will allow for a smooth process.

Death and debt is never easy, but taking important steps can help. Hence, having a good solid life insurance plan and organizing your will accordingly will provide important steps and protection for you and your family.