How Does a Title Loan Work?

A title loan offers a fast and effective way to borrow money secured against your can, bike or truck. This makes them attractive for people who own a car and need to borrow money with a bad credit score — and because they might have been turned down for traditional products such as personal loans or payday loans.

You can be eligible whether you own the vehicle outright, on lease or partially on finance.

When applying for a car title loan, you temporarily hand over the ‘title’ to the lender who owns the vehicle for the duration of the loan. So you can borrow 25% to 50% of the car’s value (sometimes upon inspection of the vehicle) and repay over 30 days.

However, if you cannot keep up with repayments and the lender has tried to collect on several occasions without success, your car could be repossessed by the lender.

Car title loans or auto title loans are also known as ‘pink slip loans’ because you hand over the pink slip stating your ownership of the vehicle when you apply.

Key Features

| Loan Amounts | $100 to $10,000 (some states will extend to $15,000) |

| Loan Duration | 15 to 30 days (but some can be for up to 7 years) |

| APR | 300% APR |

| Vehicle Value | 25% to 50% of your vehicle’s value |

| Same Day Funding | Yes |

| Collateral At Risk | Yes |

Warning: You could lose your vehicle if you do not keep up with repayments

Where Can I Find Title Loans Near Me?

Pheabs can offer title loans online across the whole of the USA including: Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, Washington DC, West Virginia, Wisconsin, Wyoming

How to Apply For a Title Loan With Pheabs

Step 1: Enter your details online, including your car’s value, model, make and mileage

Step 2: Receive an instant decision based on your car’s value, your income and affordability

Step 3: Show proof of ownership of the vehicle — either through a title or pink slip

Step 4: Some lenders will require you to drive to their location (near me) to inspect the vehicle — some lenders may not

Step 5: Subject to further checks, receive funds into your bank account within 30 minutes to 24 hours

Representative Example

Loan example: Borrow $600 title loan over 30 days, interest payments of $245 (one-time charge of $150, interest charge of $60 and title certification fee of $35) — total repayable: $845.00

Based on charges of 25% per month and 300% representative APR.

What Is The Eligibility Criteria For a Title Loan Online And What Information Do I Need to Provide?

- Applicants must be 18 years of age

- US resident

- Must be owner of the vehicle with a clear title or proof of 1st lien

- Your vehicle is in driving condition

- Used cars and classic cars are considered

- Show proof of address

- Valid ID with photo ID

- Proof of vehicle insurance

Most of the lenders we work with at Pheabs will consider a title loan with no appraisal or restrictions on vehicle age or mileage.

What Type of Vehicles Can You Use for Auto Title Loans?

- Car

- Van

- Motorcycle / Motorbike

- Pickup Truck

- Street Bike

- Motor Home

- Trailer

- Limousine

- Any On-Road Vehicle

Can I Apply for Title Car Loans Online or Does It Need To Be in Store?

With Pheabs, you have the option to start your auto title loan application online — and some lenders will be able to verify your vehicle and your ownership and be able to approve and fund your loan on the same day.

In many cases though, once you have applied and received an indicative quote, you will be recommended to a local center near you (within just a couple of miles) for your vehicle to be inspected — and then your loan can be approved as fast as possible.

Can I Get a Title Loan With Bad Credit?

Yes, title loans for poor credit or very bad credit are popular because if you own a car outright or own most of it, you can use its value to release money. This makes this type of product popular for people who might have been declined loans from their bank, personal loans or installments loans.

However, it may depend on how bad your credit is, since you still need to show that you have a stable job and regular income coming in and that you can afford monthly repayments. But if you have a car that is in good condition, you can certainly use this as collateral to get the funds you need.

Do Title Loans Have No Credit Checks?

Yes and no, there are title loans with no credit checks, instead basing your eligibility on the value of the car, whether you own it and have a stable income to make repayments. This means that some title loan companies do not need the same traditional credit checks that come with a typical unsecured loan.

However, some title lenders may carry out credit checks, just to ensure that the individual does not have any existing bad debt and is not taking on more credit than they need to. See also no credit check loans.

What Are The Regulations For Title Loans in Alabama, Mississippi, New Mexico and Tennessee?

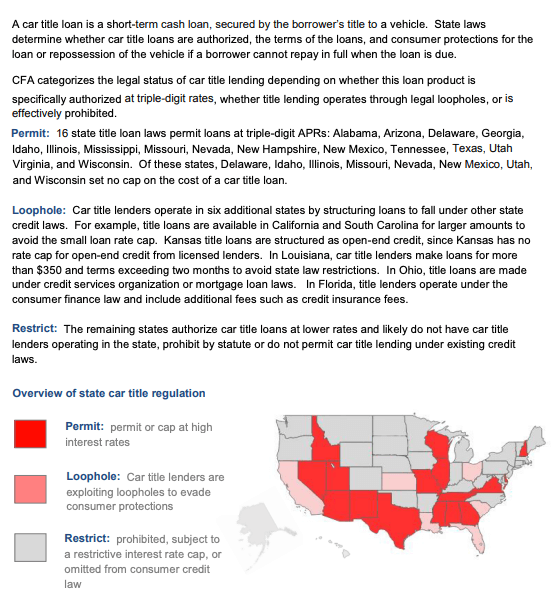

Title loans are legal in Alabama, Arizona, Delaware, Georgia, Idaho, Illinois, Texas, Mississippi, Missouri, Nevada, New Mexico, South Dakota, Tennessee, Utan, Virginia, and Wisconsin.

Illegal in other states including Michigan, New York, Alaska and Oregon.

There are some US states that allow title loans to be sold at triple-digit APRs including: Alabama, Arizona, Delaware, Georgia, Idaho, Illinois, Mississippi, Missouri, Nevada, New Hampshire, New Mexico, Tennessee, Virginia, and Wisconsin. Of these states, Delaware, Idaho, Illinois, Missouri, Nevada, New Mexico and Wisconsin set no cap on the cost of a car title loan.

FAQs For Title Loans

How Do The Repayments Work For Title Car Loans?

Title loans are often repaid over 30 days and are seen as a close alternative to payday loans. Some lenders allow you to borrow over 12 to 84 months if you require it.

Can I Apply For a Title Loans With a Used Car?

Yes you can get a title loan with a used car, provided that it is in good condition and has value. In this case, the car may be subject to an inspection and may need to be worth a certain amount for you to be eligible — and the lender will consider this on a case-by-case basis.

Can I Apply if I am Unemployed or Self-Employed?

Yes, you can complete an application if you are unemployed or on welfare, but this will need to be taken into consideration by the lender. Being able to afford repayments is key, so checking that you have some kind of income or way to meet your payments is essential.

For people who are self-employed, title loans are actually very popular, whether it is contractors, builders, handymen or drivers who want to use their vehicles to release some cash. You will not be denied for being self-employed and this could be a benefit.

Will My Car Be Repossessed if I Cannot Make Payments?

Yes, your loan is secured against the car and the lender is the temporary owner of the vehicle — so if you cannot make payments, your car will be seized to cover your repayments and the losses.

Importantly, your car will not be repossessed immediately, since the lender will try to contact you and help you to repay. The industry is regulated and the lenders are required to offer payment plans and arrangements and only as a final last resort can your can be taken away.

What Does Placing a Lien On Your Car’s Title Mean?

You may hear the phrase ‘placing a lien’ when searching about auto title loans. This is where the lender becomes a temporary owner of the vehicle during the loan term. Once you repay your loan, it is handed back to you. If you cannot meet repayments, the lender becomes the full owner of the vehicle and will take your car as payment.

Does it Matter if My Vehicle Has Multiple Owners?

Yes, all owners will need to have knowledge of the loan application and you will need permissions from all parties in order to proceed. The other parties may also be subject to checks.

What Are The Alternatives To Title Loans?

Title loans can be expensive forms of borrowing, but they are a viable option for people with bad credit. There are always a number of low cost alternatives available and you should start by speaking to family and friends who may be able to lend you money for an emergency.

You can also look at co-signer loans if you can have someone to guarantee your loan agreement. Also make sure that you have done your research before using something as collateral because you could lose this if you are unable to keep you with repayments.

Useful Guides

Ways to save money on car finance

What are the alternatives to payday loans?